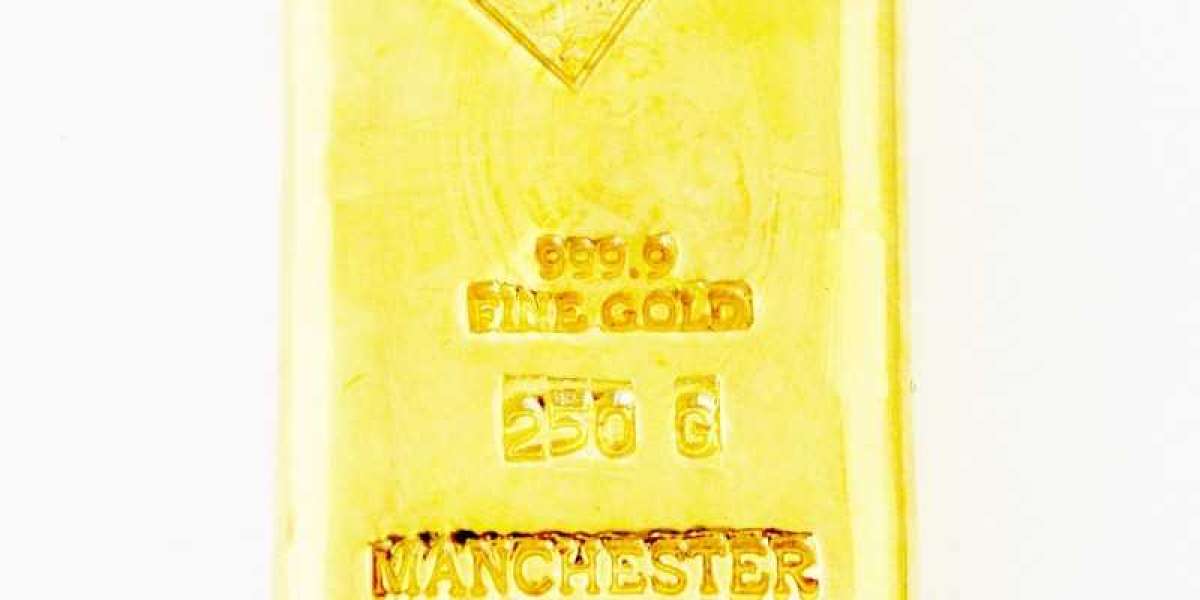

In the realm of investment, few assets have captured the imagination quite like gold. Renowned for its intrinsic value, stability, and universal allure, gold has long been regarded as a hedge against economic uncertainty and a symbol of wealth. Among the various forms in which bullion bars gold is traded, bullion bars stand out as a tangible and prestigious asset. Let's delve into the world of bullion bars, exploring their significance, practicality, and investment potential.

Understanding Bullion Bars

Bullion bars, often referred to simply as "gold bars," are refined forms of gold produced by accredited mints or refineries. These bars come in various sizes, weights, and purities, catering to a diverse range of investors and collectors. Bullion bars can be made from gold of different purities, with 99.99% pure gold being the most common standard.

The Significance of Bullion Bars

Bullion bars hold immense significance as tangible representations of wealth and prosperity. Unlike paper assets or electronic currencies, bullion bars offer investors a physical store of value that can be held, stored, and traded. Their inherent value and stability make them a preferred choice for individuals seeking to diversify their investment portfolios or safeguard their wealth against economic turmoil.

Practicality and Investment Potential

One of the primary advantages of bullion bars is their practicality and investment potential. Unlike other forms of gold, such as coins or jewelry, bullion bars are primarily valued for their weight and purity, rather than their numismatic or aesthetic qualities. This makes them an efficient and cost-effective means of acquiring large quantities of gold for investment purposes.

Liquidity and Recognizability

Bullion bars are highly liquid assets, meaning they can be easily bought, sold, or exchanged in the global marketplace. Their standardized size, weight, and purity ensure uniformity and consistency, facilitating seamless transactions between buyers and sellers. Moreover, bullion bars are universally recognized and accepted as a form of payment or exchange, further enhancing their liquidity and appeal.

Storage and Security

Proper storage and security are paramount bullion bars considerations for owners of bullion bars. Whether stored in secure vaults, safety deposit boxes, or personal safes, safeguarding these bars ensures their protection against theft, damage, or loss. Additionally, maintaining detailed records and documentation can aid in verifying their authenticity and provenance.

Conclusion

In conclusion, bullion bars represent a tangible and prestigious avenue for investing in precious metals. Their inherent value, stability, and liquidity make them an attractive choice for investors seeking to diversify their portfolios or preserve their wealth over time. Whether held for its intrinsic value, admired for its beauty, or traded for profit, bullion bars stand as a symbol of wealth, stability, and enduring value in the ever-evolving landscape of global finance.

Meet Ups

Meet Ups

Experiences

Experiences

Learning Center

Learning Center

Accommodation

Accommodation

Roomie

Roomie

Ride

Ride

Spread the Word

Spread the Word

Student Bazaar

Student Bazaar

Jobs

Jobs

Blogs

Blogs

Pin StudentInsta

Pin StudentInsta